Understanding Financial Statements: A Practical Guide for Insurance Agency Owners Understanding...

Utilizing a Statement of Cash Flows for Insurance Agency Owners

Utilizing Statement of Cash Flows: A Crucial Tool for Insurance Agency Owners

The final part of our financial statement series walks through the Statement of Cash Flows, what’s included, and why it’s different than other financial statements.

An insurance agency owner or financial manager should incorporate a Statement of Cash Flows into their accounting and business planning toolkit. This statement can offer invaluable insights and strategic advantages because it’s a more direct picture of the cash management within the agency. This article explores compelling reasons why insurance agency owners should leverage a statement of cashflows for enhanced financial clarity and informed decision-making.

What is a Statement of Cash Flows?

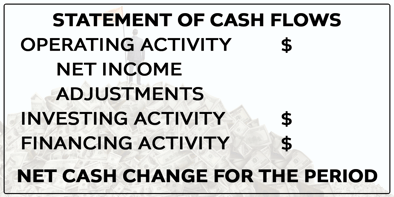

A Statement of Cash Flows (SCFs) is a financial document that provides a comprehensive summary of the cash inflows and outflows within a specific period. It serves as a crucial component of financial reporting, offering stakeholders a clear understanding of an organization's liquidity, operational efficiency, and overall financial health. SCFs are structured into three main sections: operating activities, investing activities, and financing activities. Each section delineates the sources and uses of cash, offering a holistic view of an entity's cash flow dynamics.

What is Included in the Statement of Cash Flows?

Operating Activities: This section encompasses cash transactions related to an entity's primary operations, such as commission & fee income and operating expenses. It includes cash received from commissions, payments to suppliers and employees, as well as interest and taxes paid. By scrutinizing cash flows from operations, insurance agency owners can gauge the efficiency of their core business activities and identify areas for improvement. Additionally, analyzing operating cash flows aids in evaluating the sustainability of revenue streams and assessing the effectiveness of expense management.

Operating Activity Adjustments: If using an indirect method there are some non-cash expenses recognized in net income like depreciation and amortization that need to be added back. There are also changes each month for payables and receivables that affect the cash balances of your operating account and premium trust account.

Investing Activities: The investing activities section outlines cash flows associated with the acquisition and disposition of long-term assets, including investments in securities, property, plant, and equipment. For insurance agencies, investing activities may encompass purchases or sales of books of business or agencies. By scrutinizing investing cash flows, agency owners can assess the efficacy of their investment decisions, ascertain the impact of capital expenditures on cash reserves, and strategize future investment initiatives to foster growth.

Financing Activities: This segment delineates cash flows resulting from activities related to the capital structure of the agency, including debt and equity financing. It encompasses cash inflows from borrowing or issuance of stock and cash outflows from debt repayments, dividends, or share repurchases. For insurance agencies, financing activities may encompass obtaining loans to fund expansion initiatives or returning cash to shareholders through dividend payments. Analyzing financing cash flows enables agency owners to evaluate their funding strategies, assess the cost of capital, and optimize capital structure to maximize shareholder value or distributions.

How is it Different from Other Statements?

An Income Statement, or Profit and Loss Statement, provides a period snapshot of the operating activities of the agency.

The Balance Sheet provides a summary of account balances for Assets, Liabilities, and Owner Equity at a specific point in time.

The Statement of Cash Flows connects the pieces between the net income from the profit and loss, adjustments for open operating activities such as depreciation, amortization, receivables, and payables, cash transactions from investing activities such as M&A or acquiring other assets, and cash transactions from financing activities such as dividends or loan payments.

While the Income Statement and Balance Sheet are fundamental financial statements to analyze operating profitability and financial position, the Statement of Cash Flows provides a distinct perspective on cash flow dynamics for all cash transactions.

Some Considerations for Insurance Agency Statement of Cash Flows

Not all agency management or accounting systems used by insurance agencies offer a traditional Statement of Cash Flows. Depending on the accounting reports available in your agency management system there may be alternative ways to analyze cash flows such as Cash Journal Entries or General Ledger Reports.

If you have agency-billed policies and utilize Trust Accounting, the Statement of Cash Flows can look strange. This is because even though receiving and paying this premium to carriers isn’t necessarily counted as operating revenue it is a cash activity. If you utilize QuickBooks these transactions will often be summarized in the Adjustments to reconcile net income from operations.

However, it is important to note that for fiduciary purposes you should maintain controls not to co-mingle or confuse client funds in trust with your operating funds. We recommend tracking common financial ratios using your balance sheet each month to measure your liquidity and calculating your premium trust status.

In essence, the Statement of Cash Flows complements traditional financial statements by providing a comprehensive overview of an organization's cash flow dynamics, liquidity position, and capital allocation. By analyzing cash flows, insurance agency owners can enhance financial transparency, mitigate liquidity risks, and make informed strategic decisions to drive long-term success, resilience, and achieving your goals.

Want to learn more about cash flow forecasting for your agency? Schedule an introductory call to learn more about our Fractional CFO Services